Why it’s important to know what’s changing

As we draw to the end of another tax year it’s a good idea to consider the upcoming changes the next tax year will bring. Sometimes the changes a new year brings can be small but even if they appear so, there are times they can impact individual’s income in a larger way.

There are many issues still having an impact on the economy and many industries, so planning for the year ahead and understanding how any changes may impact you is essential.

Income tax rates and thresholds for the UK and Scotland

For a few years now the tax rates and thresholds for Income Tax have been different in Scotland to the rest of the UK. Therefore, how much tax you pay on savings and non-savings income will depend on where you live within the UK.

Examples of non-savings and savings income include salaries, income from pensions, income from land and property, sole trader income and interest.

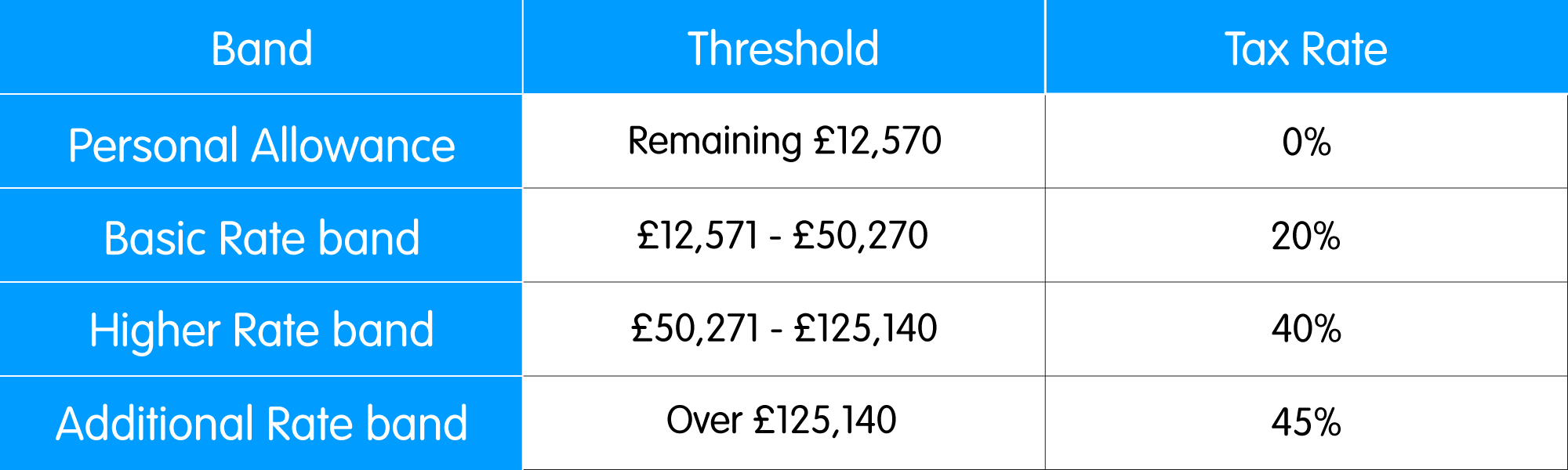

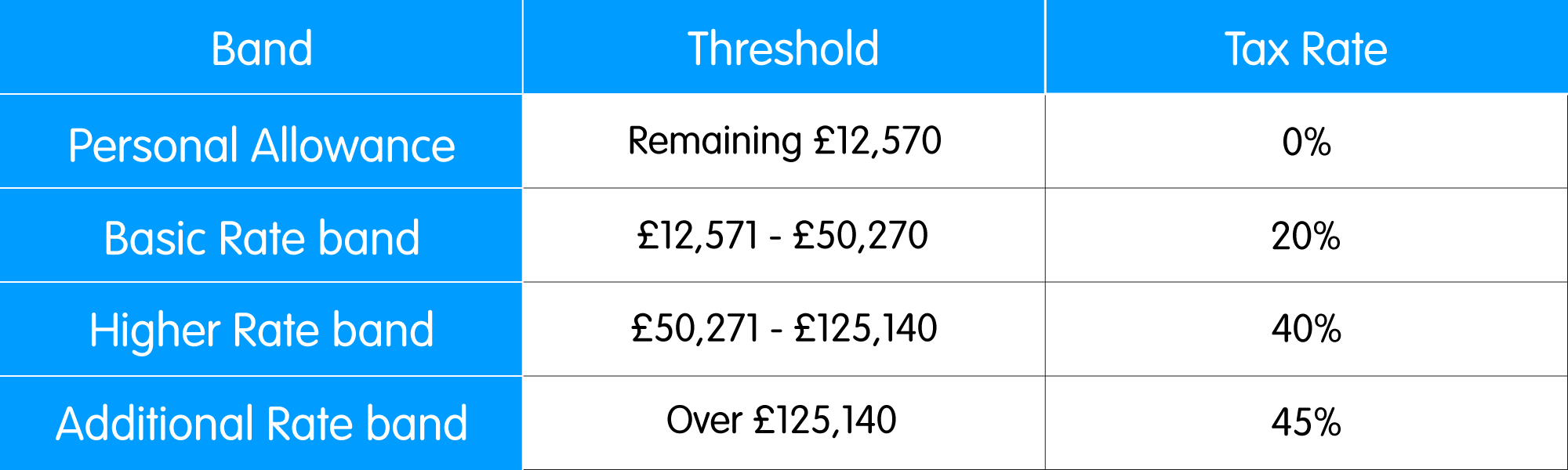

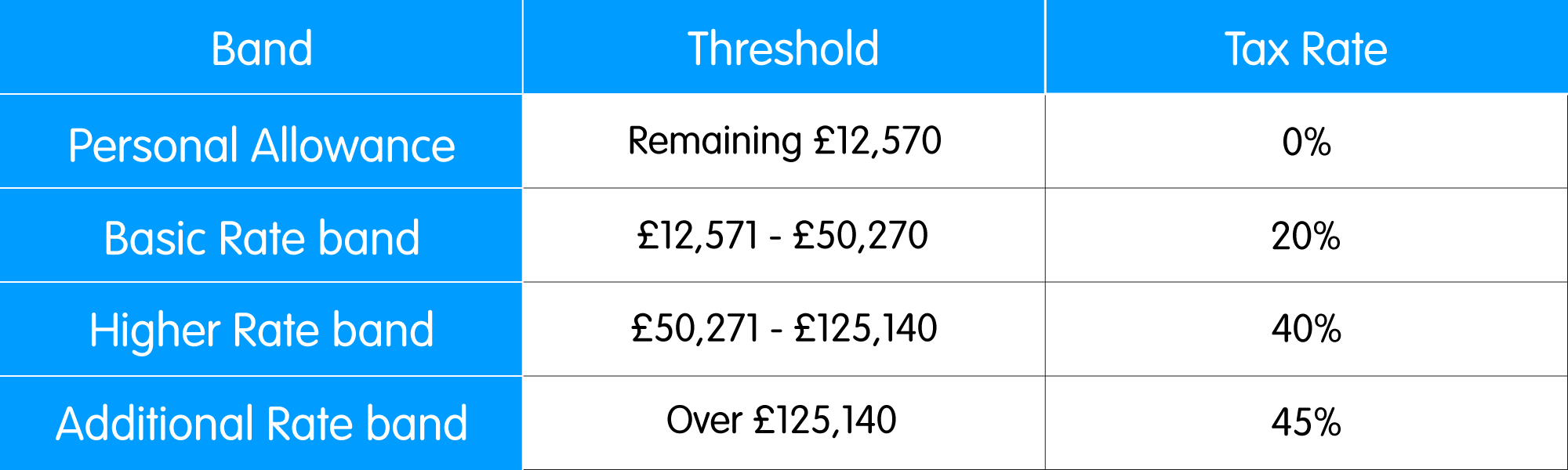

The tax rates and thresholds on this income for the UK are:

It is important to note that where your total income exceeds £100,000 in a year, your personal allowance will be reduced by £1 for every £2 you earn over £100,000. The Allowance will reduce to £0 if your earnings reach £125,140. This reduction of your personal allowance will impact all of the thresholds accordingly with the exception of the £125,140 additional rate band.

For example, if you earn £125,140 in the tax year you will have no Personal Allowance, you will pay 20% on your first £37,700 and then 40% on everything else from £37,701 to £125,140.

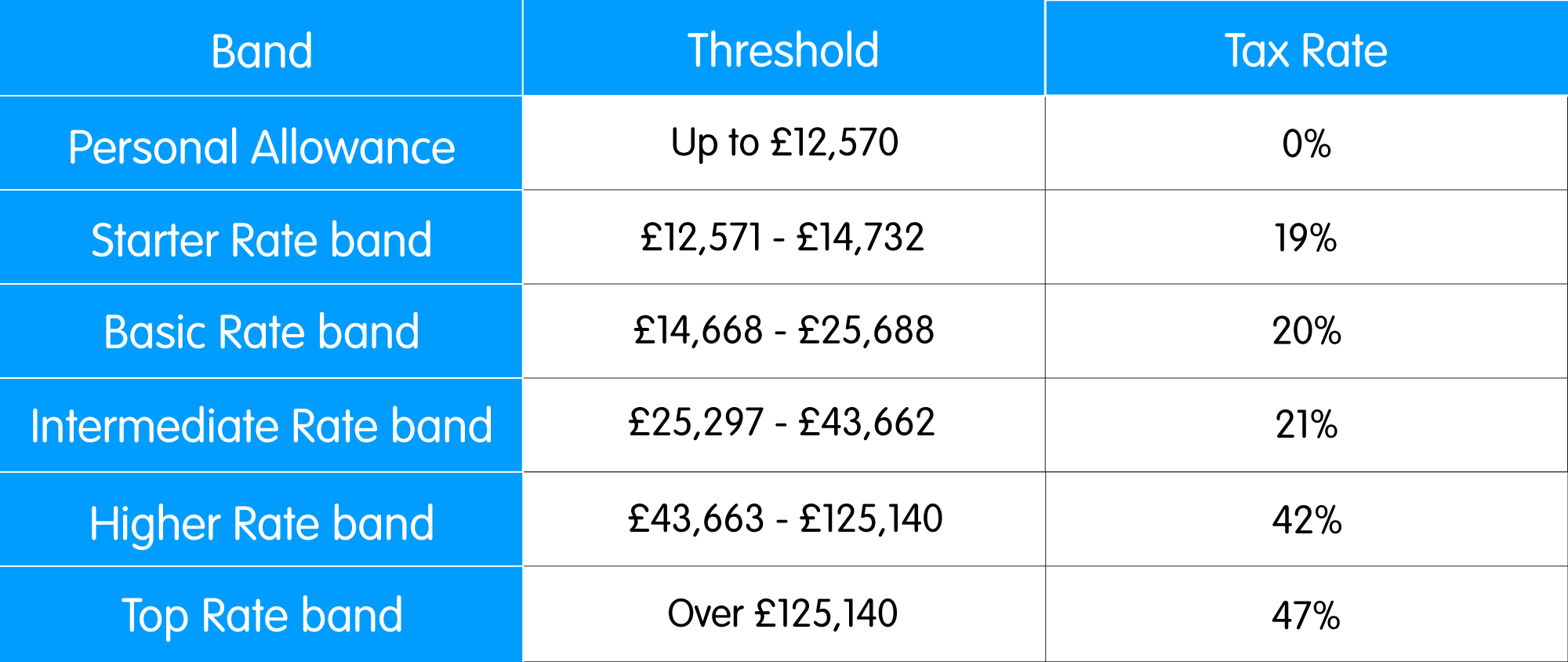

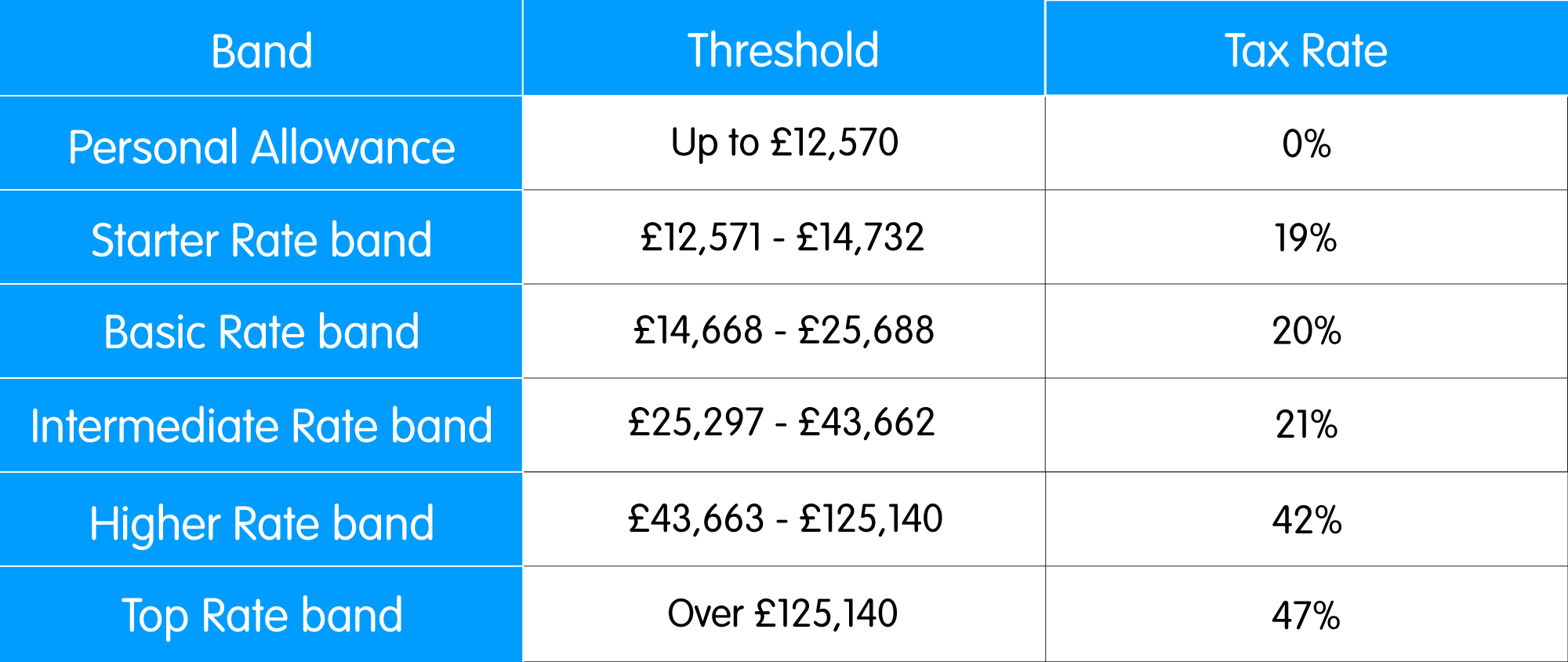

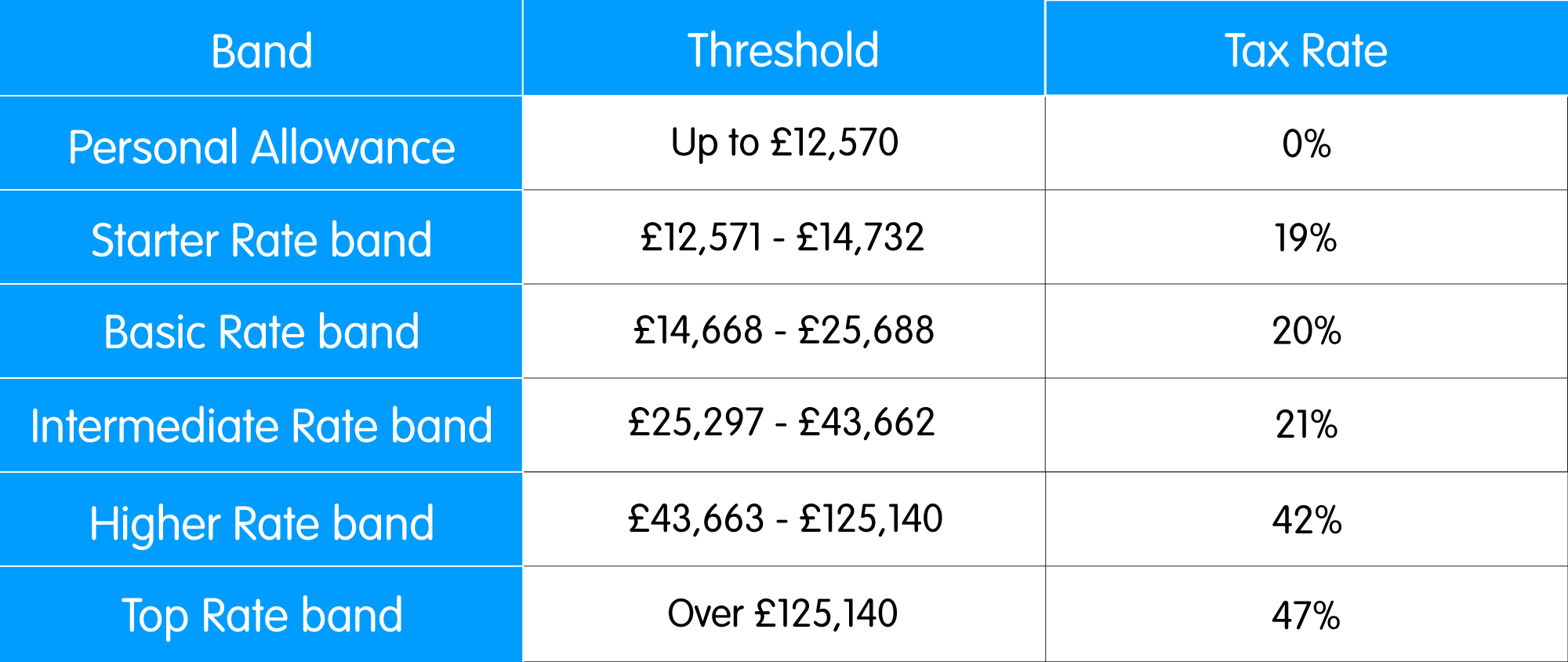

The tax rates and thresholds for Scotland are different, these are:

As with the rest of the UK, once your total income exceeds £100,000 in the year your personal allowance will be reduced by £1 for every £2 you earn over £100,000. This is in line with the rest of the UK meaning the other thresholds are impacted accordingly as a result.

We have had a few altered promises over the previous tax year which saw various changes planned only to be either reversed or changed again. Changes of note are the increase from 41% to 42% and from 46% to 47% on the Scottish Higher Rate and Top Rate bands respectively, and also the change of the Additional Rate/Top Rate threshold which has been reduced from £150,000 to £125,140.

Dividend tax rates and thresholds

From 2023/24 we will also see a change in dividend tax rates following the previous budget which sees the tax free dividend allowance reduced from £2,000 to £1,000.

The rates of tax on dividends from April 2023 will be as follows:

Basic rate dividends: 8.75%

Higher rate dividends: 33.75%

Additional rate dividends: 39.35%

The new dividend allowance will apply to all dividends declared on or after 6th April 2023.

As part of contractor tax planning consideration needs to be given to any dividends that should be taken prior to the rate change and likewise consider if deferring dividends is the preferred choice.

The correct approach for every contractor will differ, if you need advice please contact your dedicated accounts team.

It is recommended that people who are in receipt of dividend income keep a track of their dividend earnings and any subsequent tax that will be due at the end of the year. If you have an accountant they will be able to assist estimating your tax liability for you.

Tax efficient salary

For most contractors we will therefore be advising the most tax efficient salary will be £240 per week or £1,050 per month.

As always we remain on hand to provide you with tailored advice and guidance for the current and upcoming tax year. If you have any queries feel free to contact your dedicated accounts team on 0161 929 6000 (Option 3).

Capital Gains tax

If you sell or plan to sell any chargeable assets during the year, such as shares or a second home/rental property you own, these may lead to a capital gain if the profit from the sale exceeds the Capital Gains Allowance. This allowance is being reduced from £12,300 to £6,000 from 6th April 2023.Therefore if you are planning on selling any assets, you can make of the current allowance if you sell the asset before the new tax year commences.

If your profit is greater than the Capital Gains Allowance, then the rates of tax are unchanged at 10% at the Basic Rate band for non-residential property or 18% for residential property and 20% above the Basic Rate band for non-residential property or 28% for residential property.

When working out your profit on a capital disposal it is worth checking if there are any costs you can claim as an allowable expense to reduce that gain, for example enhancing a property by means of adding a conservatory or extension.

Some capital disposals may also qualify for Business Asset Disposal Relief. Gains that qualify for this are taxed at a flat rate of 10% regardless of the tax band, however there is a lifetime limit of £1 million that an individual can claim this relief on. Any qualifying gains after the first million will be taxed at the normal rates of capital gains tax.

Pensions and savings

Making contributions to a pension can provide tax relief, previously the benefits that be built up was limited by the lifetime allowance, however for tax year 2023/24 onwards this limit has been abolished. This will allow some to build up even more into a pension fund whilst enjoying the full tax benefits. however there is a lifetime limit on how much you can contribute to a pension and later withdraw whilst benefitting from this. The lifetime limit used to increase each year with inflation, but much like the Personal Allowance, this limit remains frozen at £1,073,100 until 2026. This likely will not impact most people, however those who are impacted face a 55% tax charge if they withdraw any income above this limit as a lump sum over the next 5 years or 25% if they take the money as income.

As in previous years, the limit a person can contribute into a pension pot whilst claiming tax relief is capped at a maximum of £640,000, this cap was previously £40,000, but has been increased for tax years 2023/24 onwards. For higher earning individuals this limit may be lower and for individuals earning less than £640,000 this limit will also be lower. It is advisable to seek professional advice in such instances.

Inheritance tax

Inheritance tax remains mostly much unchanged at its core for 2023/24 as estates worth £325,000 or less remain tax free and any amount exceeding this is taxed at 40%, this has also been frozen at £325,000 until 2026. There is also the Residence Nil-Rate band that can be taken advantage of, meaning that an estate including the family home benefits from up to a further £175,000 when being passed on to direct descendants. Any further increases to this allowance will be determined by the rate of inflation (CPI).

As with many other allowances however, the inheritance tax thresholds will remain unchanged until 2026.

Where a married person dies and leaves their estate to their spouse, the surviving spouse may inherit the tax free allowance from their deceased mate effectively doubling the allowance which they may pass on. For example the £325,000 tax free allowance would become £650,000. This impacts the family home allowance as well, meaning that would double from £175,000 to £350,000.

Marriage allowance

For married couples or civil partners whereby one person earns less than their personal allowance and the others earnings fall within the Basic Rate band it may be advantageous to claim marriage allowance. This allows the lower earner to transfer 10% of their personal allowance to their spouse/partner enabling them to earn a slightly higher amount before paying tax.

For 2032/24 the transferrable amount would be £1,260 which would increase the others personal allowance from £12,570 to £13,830. Where both peoples income is at or exceeds their personal allowance there is no financial benefit to this allowance.

A claim for marriage allowance must be made by the person wishing to transfer part of their allowance to the other as this would mean that their personal allowance is reduced.

As with all aspects of financial planning we would recommend that you speak to a professional about your circumstances to ensure that you are making the most of your current situation and are able to be prepared for any upcoming changes ahead.

Related Pages

Related article - Making Tax Digital: A guide for contractors

Making Tax Digital, or ‘MTD’ is the Government’s initiative to bring the UK tax system fully into the digital age. Taxpayers have been used to making Tax Returns online as have businesses and companies for some years now, but MTD is the next step up.

View now