If you are in employment or receive pension income, you may have received a 2019/20 PAYE coding notice from HMRC.

PAYE coding notices come in the form of a letter received by post or uploaded to your personal Self Assessment account with HMRC. They notify you of the PAYE code to be operated against your income and it is of course vital that you check your code is correct to ensure you do not pay too much or too little tax. This can often happen if you have more than one source of income.

For the 2019/20 tax year, the basic personal allowance will be £12,500. This means that during 2019/20, you would need to receive taxable income over £12,500 any income tax is paid. For most people their tax code in 2019/20 would be 1250L, which includes the full Personal Allowance. This would not be the case where you are not entitled to it, for example where your taxable income is estimated to exceed £100,000

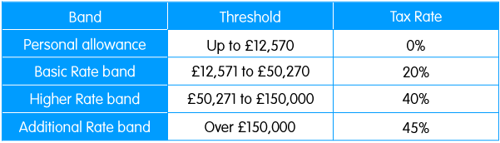

From April 2019, the threshold at which the higher rate of tax becomes payable will also be raised, meaning that you only become liable to pay any tax at 40% when your total taxable income (not just earnings from your main employment) goes over £50,000. The rates for the 2019/20 tax year are:

For Scottish residents the rates are slightly different as follows:

You also need to bear in mind any loss of personal allowance (due to your taxable income being above £100,000) or liability to the high income child benefit charge will affect how much tax you will pay.